-

The Consumer Report benchmark study has reached its eighth edition, providing valuable insights into Romanian consumer behaviour.

-

Among the most significant changes in consumer behaviour are: increased attention to prices, a decrease in weekly mobile phone activity and a decrease in time spent reading.

Starcom România launches the 2021 edition of the Consumer Report benchmark study, which analyses the behaviour of Romanian consumers’ purchasing preferences, consumption of online and offline content, home and away-from-home activities and use of technology. Now in its 8th edition, the study provides particularly valuable information for understanding consumers and their changing behaviour.

The study considered four categories of consumers, as follows:

-

Families with kids – families with children up to the age of 14, most of them aged 18-45;

-

Teens – young people aged between 14 and 17, mostly students;

-

Single Youth – aged between 18 and 34, without children;

-

Families without kids – most family members are over 45 and do not have children under 14.

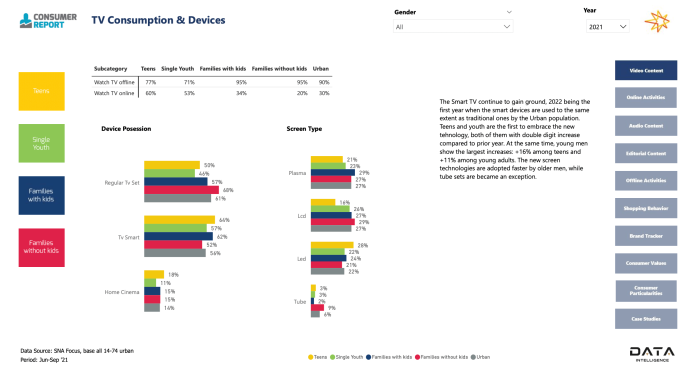

Use of TV and other devices

The Smart TV continues to gain ground, 2021 being the first year when smart devices are used to the same extent as traditional ones by the Urban population. Teens and youth are the first to embrace the new technology, both of them with double digit increase compared to the prior year. At the same time, young men show the largest increases: +16% among teens and +11% among young adults. The new screen technologies are adopted faster by older men, while tube sets are becoming an exception.

Online consumption

The possession of devices (laptop, tablet, desktop and console) decreased during the pandemic period in all segments. Most likely because people started working from home and used office equipment. On the other hand, the time spent on devices has increased, which shows that the main owners are also heavy users. Compared to the pre-pandemic period, there has been an increase in the number of smartphones across all segments, with people now preferring to access the internet more from this device.

Mobile Usage Frequency

We can see a decrease in weekly mobile activities. In most cases, people use the phone for socializing (especially Families with kids) and entertainment (especially Teens). Using email or accessing news sites are two mobile activities that increased in the past year.

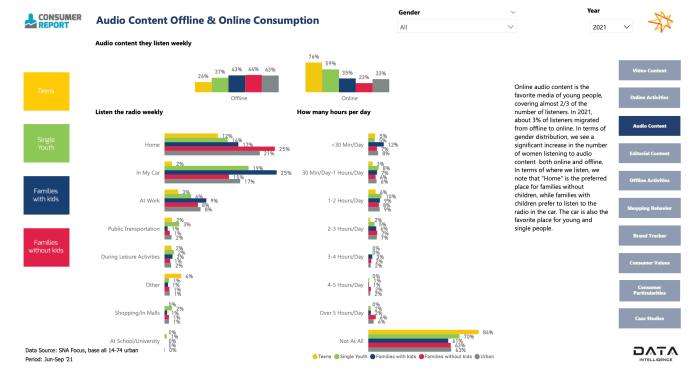

Audio content offline & online consumption

Online audio content is the favourite media content of young people, covering almost 2/3 of the number of listeners. In 2021, about 3% of listeners migrated from offline to online. In terms of gender distribution, we see a significant increase in the number of women listening to online and offline audio content. Regarding where we listen, we note that “Home” is the preferred place for families without children, while families with children prefer to listen to the radio in the car.

Radio programs & listening frequency

The overall radio consumption decreased compared to the first pandemic year, as the listening frequency decreased, especially among the younger targets from urban areas. Music remains the main reason for radio listening to this year as well. News programs lost listeners compared to 2020, mainly from mature targets.

Audio content: type of music & events

Without noticeable differences from last year, Pop / Disco / Dance music remains the favourite music of all age segments. However, teenagers and young people, especially men, are more attracted to Rap / Hip Hop music. In addition, teenagers sometimes prefer music with more moving lyrics and more complex dance styles, such as Manele or Oriental Music and Latin Music. Rock music is listened to more by teenagers and single youth, while families prefer milder rhythms.

In terms of consumers’ favourite events, across the population as a whole, with no significant gender differences, the most popular events are museum visits and music concerts. Young people tend to enjoy concerts more, while families tend to prefer theatres and museums.

Editorial content: offline versus online

Urban consumers are reading online and offline editorial content to a similar extent, with teens and single youth more interested in digital content. However, no matter the life stage, when we compare with 2020 data, we observe high decreases in both online and offline editorial content, most probably triggered by the possibility of reading similar topics on social media or posted by influencers. All consumers prefer short editorial content, reading, on average, below 30 minutes per day.

Reading frequency and book preferences

The percentage of people who do not read books has highly increased, especially among teenagers, from 58% in 2020 to 72% in 2021, but also among families with children, from 64% in 2020 to 74% in 2021. Teenagers prefer prose or poetry, most likely related to school obligations. There is a significant increase in the consumption of science fiction books among the single youth segment compared to last year, with this reading genre at the top of their preferences. Whereas in 2020, children’s books were by far the favourite among families with children, in 2021, they are at parity with prose.

The percentage of people not reading e-books is decreasing compared to 2020, especially among teenagers and young singles. Teen and Single Youth preferring to read more on a monthly or quarterly basis in 2021.

Weekly out of home activities and favorite sport

Most Romanians spend at least 3 hours a day outside their home, mainly to go for a walk or visit their friends/acquaintances. Single Youthe and teenagers are the categories who spend the most time outside their household, as they have an active lifestyle. In general, men are the ones who spend the most time outside their households.

At the level of the entire urban population, regardless of sex and age, the most popular sports remain football and athletics. Men prefer football and cycling, and women opt for other individual sports and athletics. For Singe Youth, football remains their first choice, while this year, we notice that in the preferences of teenage boys, tennis is their first choice. For young women and teenagers, handball and individual sports are at the forefront of their preferences.

Weekly home activities

In terms of home activities, we find that women are traditionally primarily concerned with cooking and reading, while men are more focused on various household fix&repair activities.

Shopping behaviour

In 2021 we noticed an increase in brand loyalty in terms of overall shopping behaviour, especially among families with kids. Teens enjoy more the shopping experience from different stores, while single youth are more price sensitive than in 2020 (most probably due to the financial uncertainty and price increase). In 2021 Romanians from urban areas are more attentive to the brand name and price than the product’s characteristics, no matter their life stage. However, we notice a higher interest in special offers manifested by Families with kids.

E-commerce

Although Romanians of all age groups continue to prefer the traditional form of shopping, online shopping has become more popular than last year among teenagers and single youth. In addition, growth is also expected among more mature consumer segments due to a period of accelerated digitisation. Small neighbourhood shops remain the favourite of urban Romanians due to their proximity and immediate supply, but we see an increase in weekly visits to supermarkets and hypermarkets, especially among teenagers and single youth. The market remains popular with families.

Also, 2021 seems to have been the year when people paid the most attention to the price of products. Families with children remain the most price-oriented and attentive to delivery terms when choosing an online retailer. At the same time, teenagers are most attracted to the site’s reputation and special offers (as they most likely don’t have a budget of their own yet). Even if the majority of Romanians from urban areas continue to use pay on delivery, we see a significant increase in website payments, especially among single youth.

In terms of preferred products, clothing and footwear remain the most popular products bought online, especially among young single women. While single youth are the main shoppers for most product types, we see that teenagers are more interested in cosmetics/personal care products (especially teenage girls) and families with children for large home appliances (especially men).

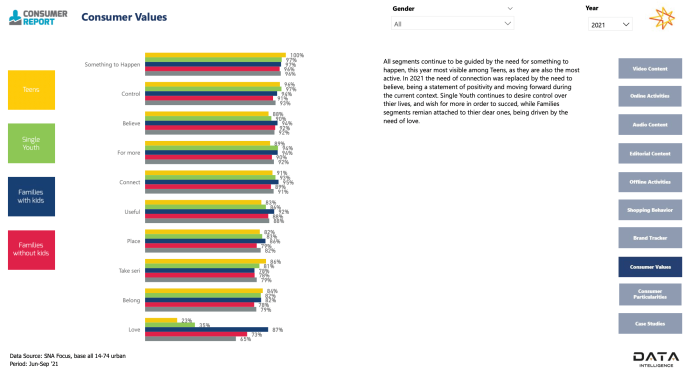

Consumer values

All segments continue to be guided by the need for something to happen, this year most visible among Teens, as they are also the most active. In 2021 the need of connection was replaced by the need to believe, being a statement of positivity and moving forward during the current context. Single Youth continues to desire control over their lives and wish for more in order to succeed, while Families segments remain attached to their dear ones, being driven by the need of love.

You can download the entire study from here: Starcom Consumer Report | Starcom Blog

Featured products

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.